On July 4, 2025, the One Big Beautiful Bill Act (P.L. 119-21) officially became law, introducing significant revisions to tax, healthcare, and legacy planning rules. Here’s what it means for you — and how it may affect your financial strategy.

Key Provisions at a Glance

1. Permanent Individual Tax Rates

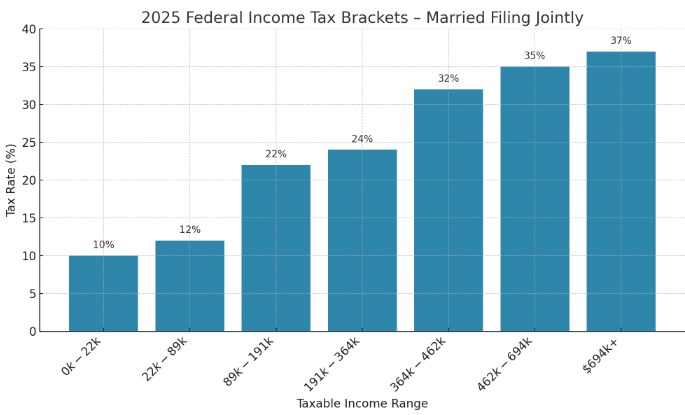

The lower income tax brackets introduced by the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent, avoiding a scheduled increase starting in 2026. This means the seven-bracket system will remain in place: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Federal Income Tax Brackets – Single Filers

2025 Federal Income Tax Brackets – Married Filing Jointly

Sources: [1], [2]

2. Higher Standard Deduction

The elevated TCJA standard deduction remains permanent: $31,500 for married couples and $15,750 for single filers (2025 figures), with future inflation adjustments. Sources: [2]

3. Expanded SALT Deduction Cap

The itemized deduction cap for state and local taxes increases to $40,000 in 2025, rising annually through 2029, before dropping back to $10,000 in 2030. Sources: [2]

4. New Deductions: Tips, Overtime & Auto Loan Interest

· Tip income: Up to $25,000 can be deducted through 2028 (phased out at higher incomes). [3]

· Overtime pay: Deductible amounts up to $25,000 (joint filers) or $12,500 (single) through 2028.

· Auto loan interest: Deductible up to $10,000 annually for new, U.S.-assembled vehicles purchased from 2025–2028 (income limits apply). [4]

5. Elevated Estate & Gifting Exemptions

Starting in 2026, estate and gift tax exemptions rise to $15 million per person (indexed thereafter), doubling for married couples. Source: [5]

What About Social Security Taxes?

We’ve received questions about whether the OBBBA changed the way Social Security benefits are taxed.

The short answer: No — the rules remain the same.

Up to 85% of your Social Security benefits may be taxable at the federal level if your provisional income (adjusted gross income + nontaxable interest + half of your Social Security benefits) exceeds certain thresholds:

Single Filers:

- Up to 50% taxable if income > $25,000

- Up to 85% taxable if income > $34,000

Married Filing Jointly:

- Up to 50% taxable if combined income > $32,000

- Up to 85% taxable if combined income > $44,000

These thresholds are not indexed for inflation and have not been updated in decades.

Key takeaway: Even with lower income tax rates being made permanent under the OBBBA, the inclusion rules for Social Security benefits have not changed — meaning careful income planning is still essential to avoid unnecessary taxation.

Source: [6]

What It Means for Your Financial Plan

- Tax planning: With permanent tax rates and deductions in place, your planning horizon may expand — there’s less urgency to accelerate income or deductions this year.

- Estate planning: The enhanced exemption amounts offer additional flexibility for legacy and gifting strategies.

- Itemized deductions: If you typically itemize, the increased SALT cap and new deductions could improve your after-tax position.

- Caution on temporary provisions: Several deductions (tips, overtime, auto interest) are temporary and slated to expire after 2028 — timing matters.

- Long-term outlook: Growth in deficits may influence future policy and interest rates; we’ll continue monitoring for relevance to your goals.

What SIG Recommends Next

- Schedule a planning review to adjust projections based on these updates.

- For those in the legacy or gifting phase, revisit your strategy now to maximize benefits.

- If any of the new deductions impact you, let’s leverage them before they sunset.

References

- Senate Finance overview of tax relief provisions, including permanent TCJA rates. https://www.finance.senate.gov/tax-reform-2025

- Stinson LLP – Legislative breakdown of TCJA continuation, SALT cap, and standard deduction changes. https://www.stinson.com/newsroom-publications-one-big-beautiful-bill-explained

- Investopedia – “No Tax on Tips” provision details. https://www.investopedia.com/fewer-than-3-of-tax-filings-can-use-the-new-no-tax-on-tips-provision-11787167

- Investopedia – Auto loan interest deduction provisions. https://www.investopedia.com/the-big-beautiful-bill-might-include-a-tax-break-on-your-auto-loan-heres-how-to-find-out-if-you-qualify-11783352

- Kiplinger – Elevated estate and gifting exemptions explained. https://www.kiplinger.com/taxes/tax-planning/advisers-tax-opportunities-for-clients-in-one-big-beautiful-bill

- Social Security Administration – “Income Taxes and Your Social Security Benefits.” https://www.ssa.gov/benefits/retirement/planner/taxes.html

This information is provided for educational purposes only and should not be construed as tax or legal advice. Please consult your SIG Financial Planner or tax advisor before taking action based on these changes.