Strategic Insights – October 2025

It’s that time of year again in Arizona. The mornings are finally cooling off, baseball playoffs are here, and yes—the snowbirds are back. For year-round residents, that means heavier traffic and longer waits at restaurants. But it also brings fresh…

Stress Testing Your Financial Foundation: Protecting What You’ve Built

Most families spend their financial planning energy on growth—building investment portfolios, maximizing returns, and preparing for retirement. Growth is exciting. But true wealth isn’t just about how much you accumulate; it’s about how well you protect it. We’ve seen families…

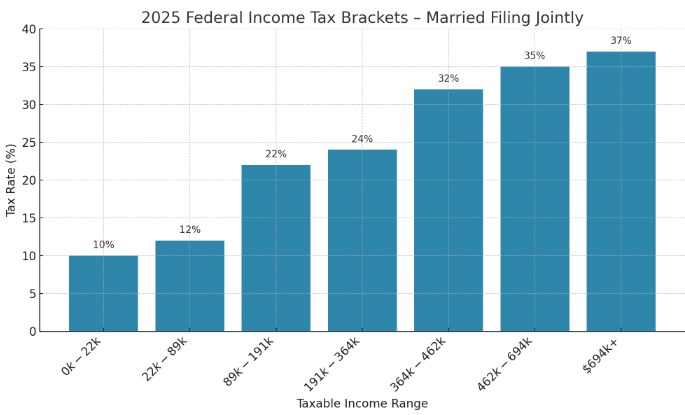

What You Need to Know: The “One Big Beautiful Bill” and How It May Affect Your Plan

On July 4, 2025, the One Big Beautiful Bill Act (P.L. 119-21) officially became law, introducing significant revisions to tax, healthcare, and legacy planning rules. Here’s what it means for you — and how it may affect your financial strategy.

Strengthening Your Foundation: How Maricopa Title Alert Enhances Your Financial Security

Protect your property with a simple, free step. The Maricopa Title Alert program notifies you by email or text any time a new document is recorded in your name, helping you respond quickly to potential title issues. Learn how this…

Strategic Insights – August 2025

In a world of headlines and uncertainty, clarity is a competitive advantage. This month, while inflation holds steady and job growth slows, the economy continues to show resilience—and so should your plan. At Strategic Income Group, we believe the best…

Post-COVID Tax Law Changes Every Investor Should Know

- 101 - Financial Stewardship & Money Management (Basic Level)

- 201 - Introduction to Investing & Wealth Growth (Basic Level)

- 301 - Retirement Planning & Income Distribution (Basic Level)

A Plain-English Guide to RMDs, Gifting, Catch-Up Contributions, and More for 2025 Since the onset of COVID-19, Congress has passed sweeping changes to the U.S. tax code—many of which have lasting implications for retirees, investors, and families focused on…

The Critical Role of Assumptions in Financial Planning: Why Strategic Income Group Stands Out

- 202 - Optimizing Wealth Through Smart Investing (Advanced Level)

- 302 - Advanced Strategies in Retirement & Generational Wealth (Advanced Level)

Financial planning is only as robust as the assumptions underpinning it. Every retirement plan relies on expectations regarding inflation, investment returns, life expectancy, Social Security benefits, and periodic expenses. Unfortunately, many financial plans falter because these assumptions are not meticulously…