When most people think about retirement planning, they focus on saving and investing as much as possible. But how you save is just as important as how much you save. The type of accounts you use can significantly affect your long-term tax liability, retirement income, and even the legacy you leave behind.

One of the most powerful but often misunderstood tools in this process is the Roth conversion. At Strategic Income Group, we use Roth conversions as part of our Phase II – Accumulation planning, where the goal is not just to grow wealth, but to do so with discipline and tax efficiency

What Is a Roth Conversion?

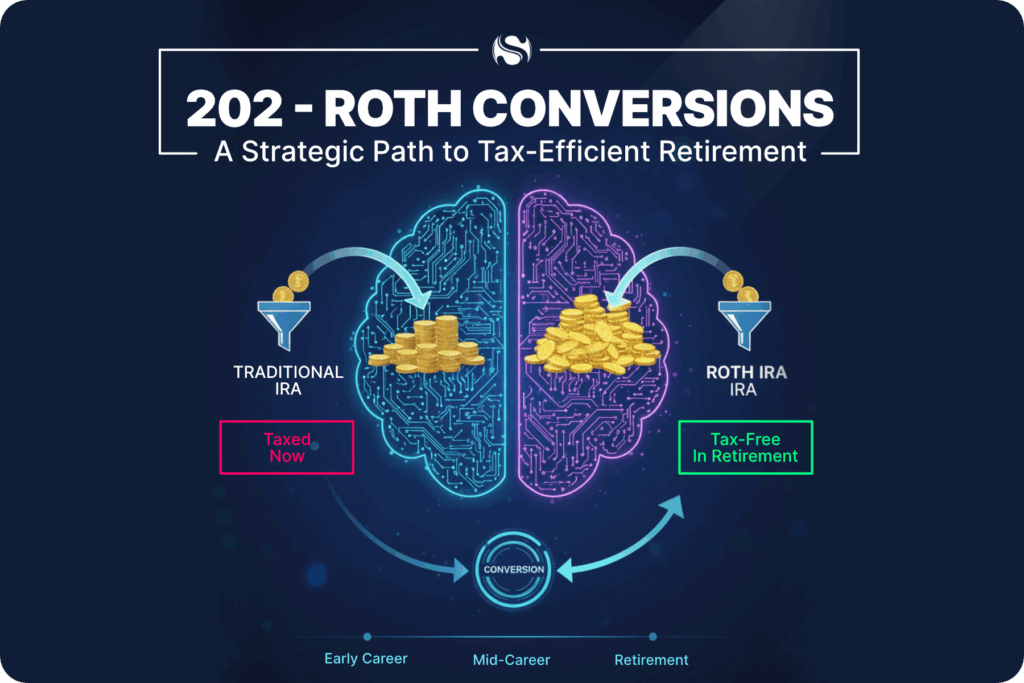

A Roth conversion is the process of moving money from a Traditional IRA or pre-tax retirement account into a Roth IRA. When you convert, you pay income taxes on the amount transferred in the year of conversion. From then on, the converted funds grow tax-free, and all qualified withdrawals in retirement are also tax-free. The concept is simple: pay taxes now, at a known rate, in order to avoid potentially higher taxes later.

How Does It Work?

- Select an amount to convert from your pre-tax IRA or retirement plan.

- Pay the income tax on that amount in the current year (using either cash on hand or withholding, though cash is generally more efficient).

- Move the funds into a Roth IRA, where future growth and withdrawals are shielded from income tax.

Timing and execution matter. Converting too much in a single year could bump you into a higher tax bracket, reduce deductions, or affect Medicare premiums. The strategy works best when integrated with a personalized tax plan.

Case Study: A Smart Roth Conversion

Consider Susan, age 60, recently retired but not yet drawing Social Security. Her income is lower than it will be in a few years once Required Minimum Distributions (RMDs) begin at age 73.

By strategically converting $100,000 from her Traditional IRA to a Roth IRA each year for five years, Susan:

- Pays tax now at a 22% marginal bracket, which she can cover from savings.

- Reduces the size of her future RMDs, keeping her future tax bracket lower.

- Creates a tax-free pool of assets to draw from in retirement, giving her flexibility.

- Leaves a tax-free inheritance to her children, who won’t face accelerated taxation under the 10-year inherited IRA rules

But for Susan, the strategy isn’t just about the numbers. Converting to a Roth gives her confidence that she can fund the retirement she’s always envisioned—traveling with her husband, supporting causes close to her heart, and helping her grandchildren with future education expenses. It also allows her to structure her legacy so that her children inherit not only wealth, but the opportunity to live generously themselves.

In this way, Roth conversions become more than just a tax strategy. For Susan, they represent a tool to live her best life now and create a lasting positive impact on the next generation.

Who Is a Good Fit?

Roth conversions often make sense for:

- Clients in a temporarily lower tax bracket (retired before RMDs, between jobs, or in a low-income year).

- Those with significant Traditional IRA balances who want to manage future RMDs.

- Clients with a long time horizon who can benefit from decades of tax-free compounding.

- Families focused on legacy planning, since Roth IRAs pass to heirs income-tax free.

When Might It Not Be the Right Fit?

Roth conversions aren’t for everyone. Situations where caution is warranted include:

- Clients who must use IRA assets to pay conversion taxes. This reduces the benefit and can trigger penalties if under age 59½.

- Those already in very high tax brackets. Converting could unnecessarily increase current tax liability without long-term benefit.

- Clients planning large charitable gifts from IRAs. Qualified Charitable Distributions (QCDs) can reduce taxes without the need for conversion.

- Short time horizon. If funds may be needed within a few years, the upfront tax cost may not be recovered through tax-free growth.

Why It Matters

Roth conversions are a powerful tool for managing lifetime tax liability, reducing RMD exposure, and creating greater flexibility in retirement. But like most advanced strategies, they require careful analysis. The right amount, timing, and tax coordination can make a meaningful difference.

This is why Roth conversions fit so naturally into SIG’s Phase II – Accumulation process. We focus not only on growing wealth, but also on ensuring that growth is managed with tax efficiency so clients can maximize what they keep.

Take Action

Every family’s tax situation is unique. A Roth conversion that is perfect for one client may be costly for another. The best way to know is to run the numbers.

If you’re wondering whether a Roth conversion could be right for you, reach out to your SIG Financial Planner. Together, we can run the calculations, evaluate the trade-offs, and determine whether this strategy can help you build a more tax-efficient retirement.

Because true planning isn’t just about growth—it’s about creating flexibility, freedom, and a legacy of financial security and positive impact.

Disclosures

Strategic Income Group, Ltd. is an SEC-registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. The information contained herein is provided for educational and informational purposes only, and should not be construed as personalized investment advice.

Examples provided are hypothetical in nature, do not reflect actual client experiences, and are not intended to represent the results of any specific investment or planning strategy. Past performance is not indicative of future results, and all investments involve risk, including the possible loss of principal.

Roth conversions involve complex tax considerations. The decision to convert should be based on your individual circumstances, including current and future tax brackets, available cash to pay conversion taxes, and long-term financial goals. Strategic Income Group does not provide tax or legal advice. Clients should consult with a qualified tax professional or attorney regarding their specific situation. Tax laws are subject to change, which may impact the effectiveness of Roth conversion strategies in the future.For additional information about Strategic Income Group, including our services, fees, and important disclosures, please review our Form ADV, available at www.adviserinfo.sec.gov.